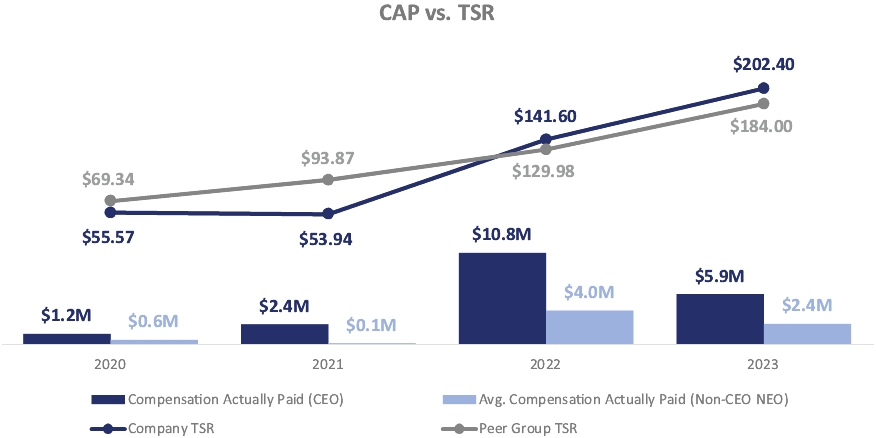

p.m. Eastern time. You will also be able to attend the meeting online, vote your shares and submit questions during the meeting by visiting the website www.virtualshareholdermeeting.com/INSW2024. In order to join the Annual Meeting virtually, you will need to have the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials (or in other communications you may have received from the broker, bank or other nominee in whose name your shares are held). The need to have the 16-digit control number included on your proxy card or in the instructions that accompanied your proxy materials (or in other communications you may have received from the broker, bank or other nominee in whose name your shares are held). 26, 2024. A list of our stockholders will be open to the examination of stockholders for any purpose germane to the Annual Meeting, during ordinary business hours for ten days prior to the Annual Meeting, at the Company’s offices, 600 Third Avenue, 39th Floor, New York, New York. person or virtually. DIRECTOR COMPENSATION Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines to promote the effective functioning of the Board and its committees, to promote the interests of all stockholders, and to ensure a common set of expectations as to how the Board, its various committees, individual directors and management should perform their functions. The amend). The Company currently separates the role of CEO and Chairman. Meetings of the Board. The Board held Under the Corporate Governance Guidelines, each director is expected to attend all Board meetings and all meetings of committees of which the director is a member. Meeting materials are provided to Board and Committee members prior to meetings, and members are expected to review such materials prior to each meeting. 2023, which was held both in person and “virtually” via live webcast. a timely basis. Guidelines provide that non-management directors refrain from transactions. request. 2023. independent registered public accounting firm, subject to stockholder ratification (though the stockholder vote is not binding on the Audit Committee, and the Audit Committee 2023. As part of its annual assessment of Board size, structure and composition, the Governance Committee evaluates the extent to which the Board as a whole satisfies the foregoing criteria. The average age of the nine (9) current directors is 64.1 years. Three (3) directors are age 59 or younger, two (2) directors are from 60 through 69 years old and four (4) directors are more than 69 years old. Two (2) directors have served as directors for three or less years, one (1) has served from three to six years and six (6) directors have served for six or more years. Three (3) of the nine (9) directors are female. Seven (7) of the directors are “independent” and three (3) are “audit committee financial experts” as defined by the NYSE or the SEC. During 2023, Mr. Nadim Z. Qureshi was a director of the Company and the Company had stockholders. Annual Meeting. The entire Board recommends that stockholders elect all nominees. 2023. 2023. As a result of the vacancy on the Compensation Committee created by the resignation of Mr. Qureshi as a director in February 2024, the Board elected Mrs. A. Kate Blankenship as a member of the Compensation Committee. (described below). when evaluating INSW’s executive compensation program and policies. Roles in Setting Executive Compensation In February 2024, Mr. Qureshi resigned from the Board of Directors and Mrs. A. Kate Blankenship was elected a member of the Compensation Committee to fill the vacancy created by Mr. Qureshi’s resignation and qualifies as “independent” under the foregoing standards. While the Compensation Committee believes the data derived from any INSW seeks to provide competitive “fixed” compensation in the form of base salary while emphasizing a generally relies on the CEO’s evaluation of each NEO’s performance (other than her own) in deciding whether to recommend and/or approve merit increases for any NEOs in a given year. In those instances where the duties and responsibilities of 2023 for Ms. Zabrocky, Messrs. Pribor, Small, Solon and Nugent were 7.7%, 6.0%, 5.9%, 9.3% and 9.3% respectively. The following table summarizes target, while for Messrs. Solon and Nugent the range was 0% to 137%. INSW Commercial/Operational Metrics. The overall INSW performance score for Goals. Each of our NEOs also had individual performance goals After the Paid. Based on the foregoing, the NEOs received the following annual cash incentive awards for $480,309. INSW The terms of the MICP, the 2020 MICP and the 2020 Director Plan are set forth in Exhibit 10.1 to the Company’s Current Report on Form 8-K dated November 25, 2016, in Exhibit 10.1 to the Company’s Current Report on Form 8-K dated April 8, 2020 (the “April 2020 Form 8-K”) and in Exhibit 10.2 to the April 2020 Form 8-K, respectively. In March Upon termination of employment for any reason, all unvested time on a similar basis to all other INSW employees. Please see the “All Other Compensation Table” in the “Summary Compensation Data” section of this Proxy Statement. Each of the employment agreements also provides for the possibility of annual equity grants at the discretion of the Board upon recommendation from the Compensation Committee. On March 12, 2024, each of their annual base salaries was increased to $435,000 from $410,000. $19,800 and for 2024 is $20,700. Hedging, Pledging and Insider Trading. INSW’s insider trading policy prohibits its directors and employees from hedging their ownership of its securities, including investing in options, puts, calls, short sales, futures contracts or other derivative instruments relating to In accordance with the rules of the SEC, the report of the Compensation Committee does not constitute “soliciting material” and is not incorporated by reference in any filings with the SEC made pursuant to the the identified stockholders was prepared based on information supplied by such stockholders in their filings with the SEC. below.

the SecuritiespartyParty other than the Registrant oCheck the appropriate box:o ☐ Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material Pursuant to §240.14a-12Sec.240.14a-12inIn Its Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant) No fee required. o Fee paid previously with preliminary materials. ☐ Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.(1)Title of each class of securities to which transaction applies:(2)Aggregate number of securities to which transaction applies:(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):(4)Proposed maximum aggregate value of transaction:(5)Total fee paid:oFee paid previously with preliminary materials.oCheck box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.(1)Amount Previously Paid:(2)Form, Schedule or Registration Statement No.:(3)Filing Party:(4)Date Filed:May 24, 2018

You areinvitedinvite you to attend the Annual Meeting of Stockholders (the “Annual“Annual Meeting”) of International Seaways, Inc. (the “Company”“Company” or “INSW”“INSW”), which willto be held at Club 101, Kenilworth Room, 101 Park Avenue, New York, New York, on Thursday, May 24, 2018,Wednesday, June 12, 2024, at 2:00 P.M.meetingAnnual Meeting will be held for the following purposes:(1) (1)To elect nine directors,Electing the names of whom are set forthten (10) director nominees named in the accompanying Proxy Statement, each to serve until the 2019 Annual Meeting of Stockholdersannual meeting of the Company;Company to be held in 2025;(2) (2)To ratifyRatifying the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year 2018;2024; and(3) (3)To approve,Approving, by advisory vote, the compensation of the Named Executive Officers for 2017 (as2023 as described in the “Compensation Discussion and Analysis” section and in the accompanying compensation tables and narrative in the accompanying Proxy Statement); andproxy statement:(4)To transact such other business as may properly be brought before the meeting.StockholdersOnly stockholders of record at the close of business on March 29, 2018April 16, 2024 (the “Record Date”) are the only stockholders entitled to notice of, and to vote at, the Annual Meeting. The stockholders list will be open to the examination of stockholders for any purpose germane to the Annual Meeting during ordinarynormal business hours for a period of ten days prior to the Annual Meeting, at the Company’s offices, 600 Third Avenue, 39th Floor, New York, New York.We are utilizing the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders over the Internet. We believe these rules allow us to provide stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. If you received a printed copy of the materials, we have enclosed a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 with this notice and the accompanying Proxy Statement.andis important so that your shares beare represented at the meeting are both very important.Annual Meeting. We urge you to vote as soon as possible by telephone, over the Internet or by marking, signing and returning by mail your proxy or voting instruction card, even if you plan to attend the Annual Meeting in person.person or virtually. If you attend the meeting and wish to vote, in person, you may withdraw your proxy and vote at that time. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in person.your name from that record holder. Your prompt consideration is greatly appreciated. By order of the Board of Directors, JAMES D. SMALL III Chief Administrative Officer, Senior Vice President, General Counsel and Secretary 12, 2018 MATERIALSMATERIAL FOR THE ANNUAL MEETING OF STOCKHOLDERSMay 24, 2018TheWEDNESDAY, JUNE 12, 2024May 24, 2018, June 12, 2024;2018 Annual Meeting of Stockholders and Meeting;fiscal year ended December 31, 2017 are available at http://www.intlseas.com/Docs.2023; andTABLE OF CONTENTS

PageINTERNATIONAL SEAWAYS, INC.600 Third Avenue, 39th FloorNew York, New York 10016PROXY STATEMENT• • • “Board”“Board”) of International Seaways, Inc. (the “Company” or “INSW”)the Company for use at the Annual Meeting of Stockholders (the “Annual Meeting”“Annual Meeting”) to be held at Club 101, Kenilworth Room, 101 Park Avenue, New York, New York on May 24, 2018Wednesday, June 12, 2024 at 2:002 p.m. localEastern time, or any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. TheYou will be able to attend the meeting online, vote your shares and submit questions during the meeting by visiting the website www.virtualshareholdermeeting.com/INSW2024. In order to join the Annual Meeting virtually, you will be held at Club 101, Kenilworth Room, 101 Park Avenue, New York, New York.12, 2018.• • March 29, 2018April 16, 2024 (the “record date”“Record Date”) will be entitled to vote at the Annual Meeting. As of the record date,Record Date, the Company had one class of voting securities, its Common Stock, of which 29,123,33149,049,288 shares were outstanding on the record dateRecord Date and entitled to one vote each (the “Common Stock”“Common Stock”).the proxyit is duly executed and received by the Company at or prior to the meeting, will be voted at the meeting in accordance with the instructions provided therein. If no such instructions are provided, the proxy will be voted (1) FOR the election of directors, (2) FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2018,2024, and (3) FOR the approval, in an advisory vote, of the compensation for 20172023 of the executive officers named in the Summary Compensation Table in this Proxy Statement (each, a “Named“Named Executive Officer”Officer” and collectively, the “Named Executive Officers” or “NEOs”“NEOs”), as described in “Compensation Discussion and Analysis” section and in the accompanying compensation tables and narrative in this Proxy Statement.20182024 requires the affirmative vote (inNamed Executive OfficersNEOs for 20172023 is non-binding, but the Board and the Human Resources and Compensation Committee (the “Compensation Committee”“Compensation Committee”) will review the voting results in connection with their ongoing evaluation of the Company’s compensation program.person.quorum. Abstentions will be counted in tabulations of the votes cast on each of the proposals presented at the Annual Meeting (and will have the same effect as “AGAINST” votes, except with respect to the election of directors where abstentions will not be counted), whereas broker “non-votes”quorum but will not be counted for purposes of determining the number of votes cast.The “NYSE”“NYSE”) rules permit brokers to vote for routine matters such as the ratification of the appointment of Ernst & Young LLP without receiving instructions from the beneficial owner of the shares. NYSE rules prohibit brokers from voting on the election of directors, executive officer compensation, and other non-routine matters without receiving instructions from the beneficial owner of the shares. In the absence of instructions, the shares are viewed as being subject to “broker non-votes.” “Broker non-votes” will be counted for quorum purposes (as they are present and entitled to vote on the ratification of the appointment of Ernst & Young LLP) but will not affect the outcome of any other matter being voted upon at the Annual Meeting.1Meeting. Under current applicable rules, unless provided with voting instructions, a broker cannot vote shares of Common Stock for the election of directors, or on the advisory vote concerning the approval of the compensation of the Named Executive Officers for 2017.As allAll of these matters are very important to the Company, and we urge you to vote your shares by telephone, over the Internet or by marking, signing and returning your proxy or voting instruction card. has been retained by the Company to assist with the solicitation of votes for a fee of up to $10,000$20,000 plus reimbursement of expenses, towhich will be paid by the Company. The Company will also reimburse brokers and others who are only record or nominee holders of the Company’s shares for their reasonable expenses incurred in obtaining voting instructions from beneficial owners of such shares.owners. Directors and officers of the Company may solicit proxies personally or by telephone or facsimile, but will not receive additional compensation for doing so.“1934 Act”“1934 Act”), any proposals of stockholders that are intended to be presented at the Company’s 20192025 Annual Meeting of Stockholders must be received at the Company’s principal executive offices no later than December 31, 2018,2024, and must comply with all other applicable legal requirements, in order to be included in the Company’s proxy statement and form of proxy for that meeting.20192025 Annual Meeting of Stockholders (the “2025 Annual Meeting”), including the nomination of directors, but who do not wish to have a proposal or nomination included in the proxy statement for that meeting, must notify the Company in writing of the information required by the provisions of the Company’s Amended and Restated By-laws (the “By-laws”“By-laws”) dealing with stockholder proposals. The notice must be delivered to the Company’s Corporate Secretary between February 22, 2019March 14, 2025 and March 25, 2019.April 14, 2025. Stockholders can obtain a copy of the By-laws on the Company’s website https://www.intlseas.com/investor-relations/governance/governance- documents or by writing the Corporate Secretary at the following address:at: Corporate Secretary, International Seaways, Inc., 600 Third Avenue, 39th Floor, New York, New York 10016.2eight directorsnine to nine directorsten effective as of the date ofat the Annual Meeting.The nine At the Annual Meeting, stockholders will vote on the ten nominees for election at the forthcoming meeting, allnamed below, eight of whom are presently directorsincumbent members of the Board and two are new independent nominees, Messrs. Darron M. Anderson and Kristian K. Johansen. Each of the eight incumbent director nominees was elected by a majority of stockholders voting at the annual meeting of stockholders held in June 2023.other than Ms. Lois K. Zabrocky, are listed below. or if Mr. Johansen fails to comply with the Company and Board policies applicable to directors.listedidentified below were selected by the Board upon the recommendation of the Corporate Governance and Risk Assessment Committee (the “Governance Committee”“Governance Committee”)., and each nominee has consented to serve if elected. Unless otherwise directed, the proxy will be voted for the election of these nominees, to serve until the 20192025 Annual Meeting of Stockholders of the Company and until their successors are elected and qualify. We are not aware of any reason the nominees would not be able to serve if elected. Three (3) of the ten (10) director nominees are women and one (1) of the nominees is a member of an underrepresented minority group.Name (age)Business Experience during the Past Five Years and OtherInformationDirectorSince

(67)Mr. Wheat has served as of the Company30, 2016. He2016 • Mr. Wheat is currently the Managing Partner of Wheat Investments, LLC, a private investment firm. firm • From 2007 to 2016, he was the founding and Managing Partner of the private equity company Southlake Equity Group. Group • untilto 2006, Mr. Wheat was the President of Haas Wheat & Partners (“Haas Wheat”Wheat”). • Prior to the formation of Haas Wheat, Mr. Wheat was a founding member of the merchant banking group at Donaldson, Lufkin & Jenrette, where he specialized in leveraged buyout financing. financing • From 1974 to 1984, Mr. Wheat practiced corporate and securities law in Dallas, Texas. Texas • Mr. Wheat is currently the ChairmanWheat’s finance and legal expertise and experience serving on numerous boards of directors make him a valuable asset to the Board of Directors of • Current Public Boards ○ OSG”OSG”) (the former parent corporation of the Company) and is also the Chairman of the board of directors of (NYSE: OSG) (Chairman) ○ (“AMN”(NYSE: AMN). He has been a (Chairman since 2007; director of AMN since 1999, becoming Chairman in 2007. He previously served as Vice Chairman of1999) • Previous Boards & Organizations: Dex Media, Inc. and served as Chairman of(Vice Chairman); SuperMedia (Chairman prior to its merger with Dex One. Mr. Wheat has also previously served as a member of the board of directors of several other companies including among others:One); Playtex Products (of which he also served as Chairman)(Chairman); Dr. Pepper/Seven-Up Companies, Inc.; DrDr. Pepper Bottling of the Southwest, Inc.; Walls Industries, Inc.; Alliance Imaging, Inc.; Thermadyne Industries, Inc.; Sybron International Corporation; Nebraska Book Corporation; ALC Communications Corporation; Mother’s Cookies, Inc.; and Stella Cheese Company. Company • Mr. Wheat received both his Juris Doctor and Bachelor of Science degrees from the University of Kansas. Kansas

• Mr. Wheat’s financeAnderson currently serves of President and legal expertiseChief Executive Officer of Stallion Infrastructure Services Ltd., a market leading temporary infrastructure services company supporting many different end-markets including the U.S. oil and gas industry (“Stallion”). • • Mr. Anderson began his career in the oil and natural gas industry as a drilling engineer for Chevron Corporation in 1998, holding positions of increasing responsibility across U.S. Land, Offshore and Canada. Mr. Anderson resigned from Chevron in 1998 to pursue an entrepreneurial career in oil field services where he spent the last 26 years building successful service organizations focused on land and offshore drilling, completion and production operations. • Mr. Anderson’s extensive leadership experience servingin the energy industry, particularly in offshore and on numerous boards of directorsland drilling, with an entrepreneurial spirit and mindset, and demonstrated significant visionary, transactional and operational improvement skills, will make him a valuable asset to the Board. 2016Other Board Experience • Current Public Boards ○ • • Mr. Anderson holds a Bachelor of Science in Petroleum Engineering from the University of Texas, Austin.

(59) • since 2005,(“TJB”), which company specializes in providing project specificproject-specific consulting services to businesses in transformation, including restructurings, interim executive management and strategic planning services. He is alsoservices • former President and Chief Executive Officer of RBX Industries, Inc. (“RBX”RBX”), which was a nationally recognized leader in the design, manufacture and marketing of rubber and plastic materials to the automotive, construction and industrial markets. Prior tomarkets • Before joining RBX in 1997, Mr. Bernlohr spent 16 years in the International and Industry Products division of Armstrong World Industries where he served in a variety ofand held various management positions. positions • Mr. Bernlohr currently serves as a directorhas significant experience in both the energy and the chairman of the audit committee of Atlas Air Worldwide Holdings, Inc.; a director and the chairman of the compensation committee of OSG (the former parent corporation of the Company); and a director and the chairman of the compensation committee of WestRock Company. Within the past five years, Mr. Bernlohrmaritime sectors having served as an independentchairman or director of the following publicly-held companies: Chemtura Corporation;Petro Rig; Hercules Offshore, Inc.; Aventime Renewable Resources; Trident Resources; San Antonio Oil and Gas S.A.; Windstar Cruise Lines; Senvion S.A.; Edison Mission Energy; and US Power Generating Company. 20163Name (age)Business Experience during the Past Five YearsSkills and OtherInformationDirectorSinceExpertise Ambassador’s International; Aventine Renewable Resources; Rock-Tenn Company; and Cash Store Financial Services, Inc. Mr. Bernlohr is a graduate of Pennsylvania State University. • Mr. Bernlohr’s experience serving as a chief executive of an international manufacturing company and his varied directorship positions make him a valuable asset to the Board.Board • Current Public Boards ○ • Previous Boards & Organizations: Atlas Air Worldwide Holdings, Inc; Chemtura Corporation; Rock-Tenn Company (a predecessor of WestRock Company); Cash Store Financial Services, Inc; Skyline Champion Corporation; OSG; and F45 Training Holdings Inc. • Mr. Bernlohr is a graduate of Pennsylvania State University

(63) • Mr. Blackley was the President and Chief Executive Officer of OSG (the former parent corporation of the Company) from January 2015 until his retirement in December 2016. 2016 • From September 2014 untilto November 2016, heMr. Blackley was the Senior Vice President and Chief Financial Officer of the Company. Company • After joining OSG in 1991, Mr. Blackley held numerous operating and financial positions. Prior to his election aspositions before he was appointed President and Chief Executive Officer, of OSG, Mr. Blackley served asincluding Executive Vice President and Chief Operating Officer of OSG from(from December 19, 2014. Mr. Blackley served as2014 to January 2015), Senior Vice President from(from May 2009 throughto December 2014, as2014), Chief Financial Officer from(from April 2013 throughto December 2014,2014) and Head of International Shipping from(from January 2009 throughto April 2013. Mr. Blackley also served as Managing Director and Chief Operating Officer of OSG Ship Management (UK) Ltd. from September 2005 through April 2013. 2013) • Mr. Blackley began his seagoing career in 1971, serving as a captain from 1987 to 1991. He1991 • Mr. Blackley’s extensive experience both with the shipping industry generally, and the Company in particular, makes him a valuable asset to the Board • Mr. Blackley does not currently serve on other public company boards • Previous Boards & Organizations: Gard P.& I. (Bermuda) Ltd.; OSG (including the Company as a wholly-owned subsidiary) • Mr. Blackley holds a diploma in Nautical Science from Glasgow College of Nautical Studies and a Master Mariner Class I license. He haslicense

• Mrs. Blankenship served as Chief Accounting Officer and Company Secretary of Frontline Ltd. from 1994 to 2005 • Mrs. Blankenship’s substantial experience in international shipping as an accountant and a Director of the Company since July 2013 through November 30, 2016 at which time the Company was a wholly-owned subsidiary of OSG. Mr. Blackley also serves on the board of Gard P. & I. (Bermuda) Ltd. Mr. Blackley’s extensive experience both with the shipping industry generally and the Company in particular make himdirector makes her a valuable asset to the Board.Board 2013Other Board Experience • Current Public Boards ○ ○ 2020 Bulkers Ltd. (OSE: 2020) • Previous Boards & Organizations: Diamond S Shipping Inc. (“Diamond S”) (until merger with the Company); Eagle Bulk Shipping Inc.; North Atlantic Drilling Ltd.; Archer Limited; Golden Ocean Group Limited; Frontline Ltd.; Avance Gas Holding Limited; Ship Finance International Limited; Golar LNG Limited; Golar LNG Partners LP; Seadrill Limited; and Seadrill Partners LLC • Mrs. Blankenship has a Bachelor of Commerce degree from the University of Birmingham • Mrs. Blankenship is also a Member of the Institute of Chartered Accountants of England and Wales

(70) • Ms. Day is President and Chief Executive Officer of Day & Partners, LLC, a maritime consulting and advisory company and • From 2020 until June 2022, she was also a senior advisor to Teneo, a full-serviceglobal capital advisory and restructuring firm Goldin Associates LLC. • Maritime,Holdings Inc. Previously, (NYSE: DHT) • Ms. Day was previously a Managing Director at the Seabury Group, a transportation advisory firm, and the Division Head of JP Morgan’s shipping group in New York. York, and has additional banking experience at Continental Illinois National Bank, Bank of America and the Export-Import Bank of the United States • Ms. Day’s extensive experience in the shipping and banking industries makes her a valuable asset to the Board • Ms. Day is a director ofdoes not currently serve on other public company boards. • Previous Boards & Organizations: DHT Holdings, Inc.; TBS International, Inc.; Tidewater, Inc.; Ocean Rig ASA; Excel Maritime Carriers Inc.; and Eagle Bulk Shipping Inc. , an owner operator of dry bulk vessels, and is chairman of its corporate governance committee and a member of its audit committee, and is a former director of DHT Maritime, Inc., TBS International, Inc., Ocean Rig ASA and Excel Maritime Carriers Inc. Certification • Ms. Day is a graduate of the School of International Relations at the University of Southern California and did graduate studies at George Washington University. University • Ms. Day is also is a graduate of the Senior Executives in National and International Security Program at the Kennedy School at Harvard University. Ms. Day’s extensive experienceUniversity

• Mr. Greenberg is a Managing Director of Cortina Partners LLC, a private equity firm that invests in and manages companies in the shipping industry make her a valuable asset to the Board.2016 David I. Greenberg (64) From 2017 to March 2022, Mr. Greenberg iswas Special Advisor (and from 2008 through 2016 was a member of the Executive Committee) for LRN Corporation, whichserving as Chief Executive Officer during 2020. LRN advises global companies on governance, ethics, compliance, culture and strategy issues. issues • For 20 years prior to 2008, Mr. Greenberg served in various senior positions at Altria Group, Inc. then(then the parent company of Phillip Morris USA,USA), Phillip Morris International, Kraft Foods and Miller Brewing — culminating in his role as Senior Vice President, Chief Compliance Officer and a member of the Corporate Management Committee. Mr. Greenberg is a managing director of Cortina20174Name (age)Business Experience during the Past Five Years and OtherInformationDirectorSince Partners LLC, a private equity firm that invests in and manages companies in the textile, health care, communications, and medical transportation and bedding industries, and is the independent director of APCO Worldwide, a global corporate communications company. • Earlier in his career, Mr. Greenberg was a partner in the Washington, D.C. law firm of Arnold & Porter. HePorter • Mr. Greenberg’s investment and legal experience, particularly with respect to governance-related matters, makes him a valuable asset to the Board • Mr. Greenberg does not currently serve on other public company boards • Other Boards & Organizations: Adventure Genie, Inc. (Chairman); Acqua Recovery (Chairman) • Mr. Greenberg attended Williams College and has Juris Doctor and Master of Business Administration degrees from the University of Chicago. Chicago

• Mr. Greenberg’sJohansen currently serves as the Chief Executive Officer of TGS ASA (“TGS”) (Oslo Stock Exchange (“OSE”): TGS), a leading energy data and intelligence company. Prior to being appointed to his current position in TGS in March 2016, Mr. Johansen held several senior executive positions at TGS, including Chief Operating Officer from 2015 to 2016 and Chief Financial Officer from 2010 to 2015. • Prior to joining TGS, Mr. Johansen served as an Associate Director of Danske Markets Inc., a Norwegian investment firm from 2000 to 2005, Executive Vice President and legalChief Financial Officer of AF Gruppen ASA, a public Norwegian engineering and construction company from 2005 to 2007 and as Executive Vice President and Chief Financial Officer of EDB Business Partner ASA (formerly OSE: TIETO), a Norwegian information technology company, from 2007 to 2010. Skills and Experience • Mr. Johansen’s wide experience of executive and board positions in the global energy industry, combined with international finance and capital markets knowledge, will make him a valuable asset to the Board. • Current Public Boards Valaris Limited (NYSE: VAL), an offshore drilling contractor • Other Boards & Organizations: Previous Boards & Organizations: Prosafe SE; Agrinos ASA; and Seven Drilling ASA. Joseph I. Kronsberg (35) Mr. Kronsberg has served in various roles at Cyrus Capital Partners, L.P. since 2006, and he is currently a Partner responsible for certain investments in the financial, shipping and energy sectors. Previously, Mr. Kronsberg worked at Greenhill & Co. as a generalist in its Mergers & Acquisitions and Restructuring departments. He currently serves as a director of OSG (the former parent corporation of the Company). Mr. KronsbergJohansen has a Bachelor of Scienceand Masters degree in EconomicsBusiness Administration from the Wharton School of the University of Pennsylvania whereNew Mexico.

Professional Experience • Mr. Stevenson served as a consultant to the Company from the merger with Diamond S until January 2022 • From March 2019 until the merger, he graduated summa cum laude. served as Chief Executive Officer, President and director of Diamond S • Mr. Kronsberg’s financialStevenson founded DSS Holdings L.P. (“DSS LP”), the predecessor of Diamond S, in 2007 and served as its Chief Executive Officer, President and a member of its board of directors since its establishment • Mr. Stevenson was previously the Chairman of the Board and Chief Executive Officer of OMI Corporation and oversaw its sale in 2007, having first joined in 1993 as Senior Vice President – Commercial Skills and Expertise • Mr. Stevenson’s substantial experience and expertise in the shipping industry and experience in investment managementknowledge of Diamond S’ affairs as its former Chief Executive Officer and President make him a valuable asset to the Board.Board Other Board Experience • Mr. Stevenson does not currently serve on other public company boards • Other Boards & Organizations: American Bureau of Shipping; Previous Boards & Organizations: Diamond S (until merger with the Company); SFL Corporation Limited (formerly named Ship Finance International Limited) (Non-Executive Chairman and subsequently director); Intermarine (Non-Executive Chairman) Education and Certification • Mr. Stevenson attended Lamar University, where he graduated with a degree in business administration 2016

Ty E. Wallach (46)Mr. Wallach is a Partner at Paulson & Co. Inc. (“Paulson”) and a Co-Portfolio Manager at Paulson’s credit funds. Since joining Paulson in 2008, he has led numerous investments in the debt and equity of distressed and leveraged companies. Prior to joining Paulson, Mr. Wallach was a Partner and Managing Director at Oak Hill Advisors, serving most recently as Co-Head of European Investments. He currently serves on the board of directors of OSG (the former parent corporation of the Company), as well as on the boards of two non-profit organizations, Focus for a Future Inc. and New Heights Youth, Inc. Mr. Wallach is a graduate of Princeton University. Mr. Wallach’s substantial financial and investment experience make him a valuable asset to the Board2016Gregory A. Wright (68)Mr. Wright co-founded One Cypress Energy LLC in 2011 and has served as its Chief Financial Officer since inception. Mr. Wright is the former Chief Financial Officer and Chief Administrative Officer of Tesoro Corporation. Mr. Wright worked for Tesoro from 1995 until his retirement in 2010, leading the company from a small exploration and production company into the third largest independent refining and marketing company in the United States. Prior to joining Tesoro, Mr. Wright worked for Valero Energy Corporation for 14 years in various positions, including Vice President of Finance, Vice President of Business Development, Vice President of Planning and Vice President of Investor Relations. Prior to joining Valero, he worked for nine years for Columbia Gas Systems Inc. in various positions in accounting, budgeting and corporate planning. Mr. Wright is a former director of OSG (the former parent corporation of the Company). He graduated from The Ohio State University with a Bachelor of Business Administration in accounting and received his Masters of Business Administration with a concentration in finance from the University of Delaware. Mr. Wright’s extensive financial leadership experience and accounting expertise make him a valuable asset to the Board.2016 (48) Professional Experience • Ms. Zabrocky has been the President and Chief Executive Officer (“CEO”) of the Company since the spin-off of the Company from OSG (the former parent corporation of the Company) on November 30, 2016 (the “Spin-Off”). Under her leadership, the Company’s operating and was President ofnewbuilding fleet has grown from 55 vessels (including six vessels held by joint ventures) to more than 80 vessels and the CompanyCompany’s revenues have increased from August 2014. under $300 million to more than $1 billion. • Prior to the spin-off,Spin-Off, Ms. Zabrocky served asNominee5Name (age)Business Experience during the Past Five Years and OtherInformationDirectorSinceSenior Vice President Co-President and Head of the International Flag Strategic Business Unit of OSG, with responsibilitywhere she was responsible for the strategic plan and profit and loss performance of OSG’s international tanker fleet comprised of 50 vessels and approximately 300 shoreside staff. fleet. • Ms. Zabrocky previously served in various roles during her more than 2425 years at OSG. She served asOSG, including Senior Vice President, of OSG from June 2008 through August 2014, when she was appointed as Co-President of OSG and HeadChief Commercial Officer of the International Flag Strategic Business Unit, of OSG. Ms. Zabrocky served as Chief Commercial Officer, International Flag Strategic Business Unit of OSG from May 2011 until her appointment asand Head of International Flag Strategic Business Unit and as the Head of International Product Carrier and Gas Strategic Business Unit for at least four years prior to May 2011. She served as a director of • Ms. Zabrocky’s long experience with the Company from November 2011 through November 2016 during which timeand the shipping industry makes her a valuable asset to the Board • Current Public Boards ○ • Other Boards & Organizations: Gard P. & I. (Bermuda) Ltd.; ITOPF Limited, a not-for-profit ship pollution advisor providing advice worldwide on responses to spills of oil, chemicals and other substances at sea; the Company was(as a wholly-owned subsidiary of OSG. OSG) • Ms. Zabrocky holds a Bachelor of Science degree from the United States Merchant Marine Academy and holds a Third Mate’s License. License • She has also completed the Harvard Business School Strategic Negotiations and Finance for Senior Executives courses. Ms. Zabrocky’s long experience with the Company and the shipping industry make her a valuable asset to the Board.courses The Board recommends a vote “FOR” the election of each of the nominees for director named in this Proxy Statement.The Board has determined that each of the director nominees other than Mr. Blackley and Ms. Zabrocky is independent within the meaning of the applicable rules of the Securities and Exchange Commission (the “SEC”) and the listing standards of the NYSE, and that each of the director nominees other than Messrs. Blackley, Kronsberg and Wallach and Ms. Zabrocky is independent under the rules of the SEC and the NYSE relating to audit committees. See “Information About the Board and Corporate Governance — Independence” below.6OWNERSHIP OF COMMON STOCK BY DIRECTORS, EXECUTIVE OFFICERSAND CERTAIN OTHER BENEFICIAL OWNERSGeneraltables below set forth certain beneficial ownership information with respectBoard has delegated to each director nominee and Named Executive Officer,the Compensation Committee the determination of the compensation of directors, including compensation for serving on Board committees. During 2023, the Company’s non-executive Chairman of the Board received an annual cash retainer of $172,000 and each personof the Company’s other non-employee directors received an annual cash retainer of $80,000. The Chairman of each of the Compensation Committee and the Governance Committee received an additional annual cash retainer of $20,000 and the Chairman of the Audit Committee received an additional annual cash retainer at the rate of $20,000 for the first six months of 2023 and at the rate of $25,000 for the second six months of 2023 for a total annual cash retainer of $22,500. Each member of the three committees (other than the committee Chairman) received an additional annual cash retainer of $10,000, except that members of the Governance Committee received an annual cash retainer at the rate of $6,500 for the first six months of 2023 and at the rate of $10,000 for the second six months of 2023 for a total annual cash retainer of $8,250. No director earned any fee for attending any Board meeting or Board committee meeting. The Company reimburses directors for their reasonable travel and lodging expenses in attending in-person Board and Board committee meetings. Directors who are also employees of the Company do not receive any additional compensation for their service on the Board. All directors’ cash compensation is knownpayable quarterly in advance.Company to be the beneficial owner of more than 5%Compensation Committee administration of the outstandingDirector Plan. The Compensation Committee, based upon consideration of information provided by the Compensation Committee’s independent advisors, has established the annual equity compensation of the non-Executive Chairman of the Board at $220,000 and the annual equity compensation of each other non-employee director at $100,000. On June 20, 2023, the Board granted the non-Executive Chairman of the Board 5,798 shares of Common Stock having a fair market value of the Company. The information with respect to beneficial ownership by the identified stockholders was prepared based on information supplied by such stockholders in their filings with the SEC. Except as disclosed in the notes to these tables$220,000 and subject to applicable community property laws, the Company believes thatgranted each beneficial owner identified in the table possesses sole voting and investment power over all Common Stock shown as beneficially owned by the beneficial owner.Beneficial ownership for the purposes of the following tables is determined in accordance with the rules and regulations of the SEC. Those rules generally provide that a person is the beneficial owner of shares if such person has or shares the power to vote or direct the voting of shares, or to dispose or direct the disposition of shares or has the right to acquire such powers within 60 days. For purposes of calculating each person’s percentage ownership,other non-employee director 2,635 shares of Common Stock issuable pursuant to options exercisable within 60 days are included as outstanding and beneficially owned for that person, but are not deemed outstanding for the purposeshaving a fair market value of computing the percentage ownership of any other person. The percentage of beneficial ownership is based on 29,123,331 shares of the Company’s Common Stock outstanding as of the record date (March 29, 2018), and excludes any treasury stock.Directors and Executive OfficersThe table below sets forth information as to$100,000, in each director, director nominee and Named Executive Officer listed in the Summary Compensation Table in this Proxy Statement, and includes the amount and percentage of the Company’s Common Stock of which each director, director nominee, each Named Executive Officer, and all directors, directors nominees and executive officers as a group, was the “beneficial owner” (as defined in regulations of the SEC)case vesting on the record date, all as reported to the Company. The addressearlier of each person identified below as of(a) June 6, 2024 and (b) the date of this Proxy Statement is c/o International Seaways, Inc., 600 Third Avenue, 39th Floor, New York, New York 10016.

Beneficially Owned(1)*Less than 0.1%(1)Includes shares of Common Stock issuable within 60 days of the record date upon the exercise of options owned by the indicated stockholders on that date.7 Timothy J. Bernlohr 108,250 100,000 — — 208,250 Ian T. Blackley 98,250 100,000 — — 198,250 A. Kate Blankenship 90,000 100,000 — — 190,000 Randee E. Day 112,500 100,000 — — 212,500 David I. Greenberg 110,000 100,000 — — 210,000 Joseph I. Kronsberg 80,000 100,000 — — 180,000 90,000 100,000 — — 190,000 Craig H. Stevenson, Jr. 80,000 100,000 — — 180,000 Douglas D. Wheat 172,000 220,000 — — 392,000 (1) Consists of annual Board fees, annual Board Chairman and annual Chairman of the Audit, Compensation and Governance Committees fees, and annual committee member fees. (2) Includes 8,986Stock awards are calculated at grant date fair value in accordance with FASB Topic 718. As of December 31, 2023, the Chairman of the Board held 5,798 shares or unvested restricted shares of Common Stock that vest on May 24, 2018, theand, as of such date, each non-employee director held 2,635 shares of the Annual Meeting of Stockholders.(3)Includes 4,992unvested restricted shares of Common Stock, that vest on May 24, 2018, the datefor an aggregate of the Annual Meeting26,878 shares of Stockholders.(4)Mr. Kronsberg is an employee of Cyrus Capital Partners, L.P. (“CCP”) which beneficially owns 4,012,212unvested restricted shares of Common Stock including 8,636 shares which were granted byat 2023 year end.(3) Mr. Qureshi resigned as a director on February 19, 2024. In connection with his resignation, the Company to CCP under the Company’s non-Employee Director Incentive Compensation Plan (of which 4,992 shares vest on May 24, 2018, the date of the Annual Meeting of Stockholders). The grant was made to CCP pursuant to agreements between CCP and Mr. KronsbergQureshi entered into an agreement under which, CCP is required to receive all compensation in connection withamong other matters, the Company accelerated the vesting of Mr. Kronsberg’s directorship. Mr. Kronsberg disclaims beneficial ownershipQureshi’s 2023 stock award of all Company securities held by CCP except to the extent of his pecuniary interest therein, if any.(5)Mr. Wallach is a Partner at Paulson and a Co-Portfolio Manager at Paulson’s credit funds. Paulson is the investment manager of certain funds and accounts which beneficially own 3,456,773 shares of Common Stock. Mr. Wallach disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein, if any.(6)Includes 38,040 shares issuable upon the exercise of options.(7)Includes 32,311 shares issuable upon the exercise of options.(8)Includes 76,559 shares issuable upon the exercise of options.(9)Includes 150,645 shares issuable upon the exercise of options.Set forth below is information regarding stockholders of the Company’s Common Stock that are known by the Company to have been “beneficial owners” (as defined in regulations of the SEC) of 5% or more of the outstanding shares of the Common Stock as of the record date, as reported to the SEC.*Unless otherwise stated in the notes to this table, the share and percentage ownership information presented is as of the record date.(1)Based on a Schedule 13D filed on February 1, 2018 with the SEC by BlackRock, Inc. (“BlackRock”) with respect to the beneficial ownership of 1,698,5722,635 shares of Common Stock as(having a fair market value at the time of December 31, 2017 by BlackRockthe award of $100,000), the Company will not seek any reimbursement of the cash director fees paid to Mr. Qureshi in advance for the first quarter of 2024 and certain of its subsidiaries. The address of BlackRock is 55 East 52nd Street, New York, New York 10055.(2)Based on a Schedule 13D filed on December 9, 2016 and two Form 4s filed on April 4, 2018Mr. Qureshi agreed not to (i) compete with the SEC by the BlueMountain Funds with respect to beneficial ownership of 3,409,442 shares, the beneficial ownership of which was shared in its entirety among BlueMountain Capital Management, LLC (“Investment Manager”), BlueMountain GP Holdings, LLC (“GP Holdings”), BlueMountain Nautical LLC (“Nautical”), BlueMountain Guadalupe Peak Fund L.P. (“Guadalupe”),Company’s crude and BlueMountain Long/Short Credit GP, LLC (“General Partner”). The principal business of: (i) each of Nautical and Guadalupe is to serve asproduct tanker operations for a private investment fund; (ii) the General Partner is to serve as the general partner of Guadalupe and certain other private funds for which the Investment Manager serves as investment manager; (iii) GP Holdings is to serve as the sole owner of the General Partner and a number of other entities which act as the general partner of private investment funds for which the Investment Manager serves as investment manager (including Guadalupe); and (iv) the Investment Manager is to serve as investment manager to a number of private investment funds (including Guadalupe), to serve as non-member manager of Nautical and to make investment decisionsone year period commencing on behalf of such entities. The business address of Nautical, Guadalupe, the General Partner, Investment Manager and GP Holdings is 280 Park Avenue, 12th Floor, New York, New York 10017.(3)Based on a Schedule 13D filed on January 8, 2018 with the SEC by Cobas Asset Management, SGIIC, SA (“Cobas”) with respect to the beneficial ownership of 2,997,063 shares of Common Stock as of December 22, 2017 by Cobas. The address of Cobas is Jose Abascal, 45 St. 28003 Madrid, Spain.(4)Based on a Schedule 13D filed on December 9, 2016 and a Form 4 filed on June 12, 2017 with the SEC (as supplemented by a Form 13F filed on February 14, 2018) by Cyrus Capital Partners, L.P. (“CCP”) with respect to beneficial ownership of 4,012,212 shares by each of CCP and Cyrus Capital Partners GP, L.L.C. (“CCPGP”) of which 8,636 were granted to CCP pursuant to agreements between CCP and Mr. Joseph Kronsberg relating to the Company’s non-Employee Director Incentive Compensation Plan (of which 4,992 shares vest on May 24, 2018 the date of the Annual Meeting of Stockholders). As the (i) principal of CCPhis resignation and (ii) principalsolicit any employee of Cyrus Capital Partners GP, L.L.C., the general partnerCompany or retain the services of CCP, Stephen C. Freidheim (“Freidheim”) may be deemedany such employee for a two year period commencing on the beneficial ownerdate of 4,007,220 shares of Common Stock. The address of each of CCP, CCPGP and Freidheim is 399 Park Avenue, 39th Floor, New York, NY 10022.his resignation.(5)Based on Schedule 13G filed on February 12, 2018 with the SEC by Donald Smith & Co., Inc. (“DS”) with respect to the beneficial ownership of 2,407,644 shares of Common Stock as of December 31, 2017 by DS, and one of its subsidiaries and John Hartsel, an individual. The address of DS, its subsidiary and Jon Hartsel is 152 West 57th Street, New York, New York 10019.(6)Based on Schedule 13D filed on December 12, 2016, and Form 4s filed on June 30, 2017 and March 19, 2018, with the SEC by Paulson & Co. Inc. (“Paulson”) with respect to beneficial ownership of 3,456,773 shares by Paulson. Paulson is the investment8advisor,manager, of PCO Shipping LLCmandated by directive or policy and certain separately managed accounts (collectively,that the “Paulson Accounts”), which in the aggregate held or owned 3,456,773 shares of Common Stock asethics, character, integrity and values of the filing date.Company’s directors and senior management remain the most important safeguards in quality corporate governance. The address of Paulsonbusiness and the Paulson Accounts is c/o Paulson & Co. Inc., 1251 Avenueaffairs of the Americas, 50th Floor, New York, NY 10020.(7)Based on Schedule 13G filed on February 9, 2018 with the SEC by The Vanguard Group (“Vanguard”) with respect to the beneficial ownership of 1,559,287 shares of Common Stock as of December 31, 2017 by Vanguard and one of its subsidiaries. The address of Vanguard and its subsidiary is 100 Vanguard Blvd., Malvern, Pennsylvania 19355.9INFORMATION ABOUT THE BOARD AND CORPORATE GOVERNANCEBoard believes that ethics and integrity cannot be legislated or mandated by directive or policy and that the ethics, character, integrity and values of the Company’s directors and senior management remain the most important safeguards in quality corporate governance. The Corporate Governance Guidelines are posted on the Company’s website which is www.intlseas.com https://www.intlseas.com/investor-relations/governance/governance-documents, and are available in print upon the request of any stockholder of the Company.request. That website and the information contained on that site, or connected to that site, are not incorporated by reference in this proxy statement. UnderProxy Statement. Mergers and other business combinations may be approved by the Corporate Governance Guidelines, each director is expectedaffirmative vote of holders of a majority of outstanding shares of Common Stock (unless the transaction would require the amendment of any provision of the Company’s Articles of Incorporation or By-laws requiring a greater percentage to attend all Board meetings and all meetings of committees of which the director is a member. Meeting materials are provided to Board and Committee members prior to meetings, and members are expected to review such materials prior to each meeting.“Chairman”“Chairman”) in the manner it considers in the best interests of the Company. The Guidelines provide that if the Board determines that there should be a Chairman, he or she may be a non-management director or the CEO. the standards established by the NYSE, the Board must consist of a majority of independent directors. As determined by the Board, as of the date of this Proxy Statement, all of the nominees other than Mr. Ian T. Blackley and Ms. Lois K. Zabrocky and Mr. Craig H. Stevenson, Jr. have been determined to be independent under the Corporate Governance Guidelines for purposes of service on the Board, because no relationship was identified that would automatically bar any of them from being characterized as independent, and any relationships identified were not so material as to impair their independence. In addition, the Board has determined that all of the nominees other than Messrs. Blackley, KronsbergMs. Lois K. Zabrocky and Wallach and Ms. ZabrockyMr. Craig H. Stevenson, Jr. are independent for purposes of serving on the Audit Committee. The Board annually reviews relationships that directors may have with the Company to make a determination of whether there are any material relationships that would preclude a director from being independent. See “— Related Party Transactions” below.Board Oversight of Risk Management. While the responsibility for management of the Company’s material risks lies with management of the Company, the Board provides oversight of risk management, directly and indirectly, through its committee structure. The Board performs this oversight role by using several different levels of review. The Board and the Governance Committee receive regular reports from key members of management responsible for specified areas of material non-financial risk to the Company. In addition, the Board10reviews the risks associated with the Company’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company.At the committee level, the Audit Committee regularly reviews the financial statements and financial and other internal controls. Further, the Audit Committee meets in private sessions individually with certain members of management and with representatives of the independent registered public accounting firm at the conclusion of every regularly scheduled meeting, where aspects of financial risk management are discussed as necessary. The Governance Committee manages risk associated with Board independence, corporate governance and potential conflicts of interest as well as oversight over non-financial risk assessments associated with the Company’s operations. The Compensation Committee annually reviews executive compensation policies and practices and employee benefits, and associated risks. Both the Audit Committee and the Compensation Committee also rely on the advice and counsel of the Company’s independent registered public accountants and independent compensation consultants, respectively, to raise awareness of any risk issues that may arise during their regular review of the Company’s financial statements, audit work and executive compensation policies and practices, as applicable.Managing risk is an ongoing process inherent in all decisions made by management. The Company has an enterprise risk management program that is designed to ensure that risks are taken knowingly and purposefully. Management is responsible for assessing all the risks and related mitigation strategies for all material projects and initiatives of the Company prior to being submitted for consideration by the Board.15nine meetings during 2017.2023. Each director attended at least 75% of the total number of meetings of the Board and Board committees of which the director was a2017.Ethics. The Company has adopted a code of business conduct and ethicsEthics, which is an integral part of the Company’s business conduct compliance program and embodies the commitment of the Company and its subsidiaries to conduct operations in accordance with the highest legal and ethical standards. The Code of Business Conduct and Ethics applies to all of the Company’s officers, directors and employees. Each is responsible for understanding and complying with the Code of Business Conduct and Ethics. The Company also has an In addition, the Company has an Thethe Insider Trading Policy and the Anti-Bribery and Corruption Policy are postedto any of our directors or executive officers, or if we amend such policies, we will, if required, disclose these matters through that section of our website on the Company’s website, which is www.intlseas.com, and are available in print upon the request of any stockholder of the Company. That website and the information contained on that site, or connected to that site, are not incorporated by reference in this Proxy Statement.11ChairmanChair of the Governance Committee of the change and offer to resign from the Board. In such case, such Committee must recommend to the Board the action, if any, to be taken with respect to the offer of resignation, taking into account the appropriateness of continued Board membership. submits and requires its directors and executive officers to complete Director and Officer questionnaires identifying any transactions with the Company in which the director or officer has an interest. Management and the legal department carefully review the terms of all related party transactions. Managementtransactions, and management reports to the Board on all proposed related party transactions with directors and executive officers. Upon the presentation of a proposed related party transaction to the Board, the related party (if such related party is a director) is excused from participation and voting on the matter. In deciding whether to approve the related party transaction, the Board determines whether the transaction is on terms that could be obtained in an arm’s length transaction with an unrelated third party. If the related party transaction is not on such terms, it will not be approved.The During 2023 and through the date of this Proxy Statement, the Company entered into severaldid not have any related party transactions in 2016 with OSG, the former parent corporation of the Company. These transactions are described in Note 12, “Related Parties” to the audited financial statements of the Company for 2017 included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.thesethe Board committees has a charter that is posted on the Company’s website at https://www.intlseas.com/investor-relations/governance/governance-documentsand is available in print upon the request of any stockholder of the Company.2017 until the Annual Meeting of Stockholders in 2017,2023, the Audit Committee consisted of Messrs. Gregory A. Wright (Chairman),Ms. Randee E. Day (Chair), Mr. Ian T. Blackley, Mrs. A. Kate Blankenship and Ronald Steger. After the Annual Meeting in 2017, Mr. David I. Greenberg replaced Mr. Steger.Greenberg. The Board determined that for 2016-2017 Messrs. Stegereach of Ms. Day, Mr. Blackley and Wright wereMrs. Blankenship is an audit committee financial experts,expert, as defined by rules of the SECSecurities and NYSE,Exchange Commission (the “SEC”) and that for 2017-2018 Mr. Wright and Ms. Day are audit committee financial experts.NYSE. The Audit Committee met sixfive times in 2017.122017 until the Annual Meeting of Stockholders in 2017,2023, the Governance Committee consisted of Ronald Steger (Chairman)Mr. David I. Greenberg (Chair), Mr. Timothy J. Bernlohr and Gregory A. Wright. After the Annual Meeting in 2017, Mr. David I. Greenberg replaced Mr. Steger as a member and as Chairman.Ian T. Blackley. The Governance Committee met fivesix times in 2017.operations.operations, including cybersecurity threats. The Governance Committee’s risk assessment responsibilities include oversight of the Company’s quality of services, the Company’s vessels’ adherence to environmental and regulatory requirements, and an assessment of the scope and amount of the Company’s insurance coverage. The Governance Committee also meets with the General Counsel (in his capacity as compliance officer) in executive session from time to time as needed. As part of its duties, the Governance Committee also aids the Board by providing a review of the Board performance on an annual basis.current directorsten (10) director nominees (of whom three are women and director nomineesone is a member of an underrepresented minority group) have the requisite character, integrity, expertise, skills, and knowledge to oversee the Company’s business in the best interests of the Company’s stockholders and does not believe at this time that the long-term goal of greater Board diversity is sufficient to merit replacing existing directors.13AllEight (8) of the ten (10) director nominees for election at the Annual Meeting other than Ms. Zabrocky were previously elected to the Board by the stockholders at the Annual Meeting of Stockholders in 2017.20182024 in order for a candidate to be considered for election at the 20192025 Annual Meeting. Each recommendation for nomination should contain the following information: (a) the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; (d) such other information regarding each nominee proposed by such stockholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had such nominee been nominated, or intended to be nominated, by the Board; and (e) the consent of each nominee to serve as a director of the Company if so elected.2017,2023, the Compensation Committee consisted of Mr. Timothy J. Bernlohr (Chairman)(Chair), Ms. Randee E. Day, and Ty E. Wallach.Mr. Nadim Z. Qureshi. The Compensation Committee met six (6) times in 2017.14 International Seaways, Inc. Audit Committee: Randee E. Day, Chair A. Kate Blankenship Ian T. Blackley David I. Greenberg April 26, 2024 • • • • COMPENSATIONOFFICERS (PROPOSAL NO. 3)&A”&A”) provides information regarding thediscusses our 2023 executive officer compensation program for our executive officers in 2017.program. It describes our compensation philosophy; the objectives of the executive compensation program and policies in 2017;2023; the elements of the compensation program; and how each element fits into our overall compensation philosophy. The Compensation Committee oversees the compensation paid to all of our executive officers, including pursuant to theunder their employment agreements described below under “Employment Agreements with the NEOs.”Until November 30, 2016, INSW was a wholly-owned subsidiary of OSG. On November 30, 2016, OSG completed the spin-off of INSW (the “Spin-Off”) as a newly independent public company. Although INSW’s compensation policies prior to the Spin-Off were substantially the same as those of OSG, in 2017 the Compensation Committee has developed an independent set of policies and practices to support the Company’s compensation philosophy and strategy.“Named“Named Executive Officers”Officers” or “NEOs”“NEOs”) is includedset out in the Summary Compensation Table infollowing this CD&A. OurIn 2023, our NEOs for 2017 were:(all of whom were employees of INSW throughout the year) were as follows: NEOs Position (“(“CEO”) Senior Vice President, Chief Financial Officer (“CFO”CFO”), Senior Vice President and Treasurer Chief Administrative Officer, Senior Vice President, General Counsel & Secretary Senior Vice President (Chief Commercial Officer) Senior Vice President (Head of Ship Operations)(Chief Technical and Sustainability Officer)All of the NEOs were employees of INSW throughout 2017.2017 Performance Highlightsyear 2016years 2021, 2022 and 2017 were2023 are important factors in understanding our 20172023 executive compensation. AsPlease refer to “Who We Are – 2023 in Review” above for a summary of our recent achievements. INSW posted the strongest financial results in our Company history in 2023, as described in greater detail in our 2023 Annual Report for 2017 on Form 10-K, a(a copy of which you can be obtainedobtain as described in “Other Matters” below, we faced a challenging market last year. Performance highlights included:below).Time charter equivalent (“TCE”) revenues for Say-on-Pay Resultsdecreased in 2017 by $110.0 millionhas provided stockholders with an annual advisory vote to $275.0 million from $385.0 million in 2016.Earnings from shipping operations (“ESO”) (as hereafter defined) for INSW was $43.9 millionapprove executive compensation since our first annual meeting of stockholders in 2017. ESO is income from vessel operations before depreciationAll INSW proposals during this time, except for 2022 and amortization2023, received greater than 89.5% stockholder support. In 2022 and gains2023 approximately 68% and losses from vessel sales (including impairments) reduced by payments for drydockings and vessel expenditures.INSW’s loss for 2017 was $106.1 million, or a per-share loss of $3.64, compared with net loss of $18.2 million, or per-share loss of $0.62 for 2016. Net loss for 2017 reflects impairment charges on vessels aggregating $88.4 million due to factors set forth in Note 5, “Vessels, Deferred Drydock and Other Property,” to INSW’s consolidated financial statements included in INSW’s Annual Report on Form 10-K for the year ended December 31, 2017.INSW’s 2017 Adjusted EBITDA was $117.0 million, a $105.0 million decrease from $222.0 million in 2016. Adjusted EBITDA consists of EBITDA (which represents net loss before interest expense, income taxes and depreciation and amortization expense) adjusted for the impact of certain items that INSW does not consider indicative of our ongoing operating performance, as disclosed in Item 6, “Selected Financial Data” on Form 10-K for 2017.INSW’s total cash (including restricted cash) was $70.6 million as of December 31, 2017, compared to $92.0 million as of December 31, 2016.15During 2017, INSW refinanced its principal credit facility and made significant progress growing and renewing the Company’s fleet by acquiring three vessels (two newly constructed Suezmax tankers and a 2010-built VLCC)64% (excluding broker non-votes), selling four older MR tankers (which delivered to borrowers between August 2017 and February 2018) and entering into a letter of intent to acquire six VLCCs built in 2015 and 2016 from Euronav NV (subject to certain conditions).Say-on-Pay ResultsAt INSW’s 2017 Annual Meeting of Stockholders, approximately 99.7%respectively, of the stockholders who voted on the say-on-pay proposal voted supported it. INSW’s the Company’s advisory proposal on the executive compensation program. In considerationat the 2023 annual meeting of these results,stockholders. At INSW’s Compensation Committee acknowledged the support received from its stockholders and viewed the results as a confirmation of the Company’s existing executive compensation policies and decisions.Through the “frequency of say-on-pay” vote held in 2017, approximately 96%2023 annual meeting, more than 82% of the stockholders who voted, on the proposal cast votesvoted in favor of the say-on-pay proposal if one were to exclude the votes on the advisory proposal on executive compensation cast by Famatown. In addition, as noted earlier in this Proxy Statement, following discussions with representatives of Seatankers, an affiliate of Famatown, the Company holdinghas nominated Mr. Kristian K. Johansen as a director nominee.reflecting the practice that had been adopted by the Companyits stockholders, whose vote frequency was approved by stockholders in connection with the Spin-Off.2023. The Company anticipates that itsCompany’s next “frequency of say-on-pay”“say-when-on-pay” vote will be conducted at the 20232029 Annual Meeting of Stockholders. The Compensation Committee will continue to engage with its stockholders and will consider feedback from them, as well as the results from this year’syears and future advisory votes on executive compensation, as well as feedback from stockholders.INSWshort-andshort- and long-term. We structure ourgoals. The compensation programgoals, and is designed with the following objectives in mind:Objectives:•• Attract, motivate, retain and reward highly-talentedhighly talented executives and managers, whose leadership and expertise are critical to our overall growth and success. •• Align the interests of our executives with those of our stockholders. •• Support the long-term retention of the Company’s executives to maximize opportunities for teamwork, continuity of management and overall effectiveness. •• Compensate each executive competitively (1) within the marketplace for talent in which we operate; (2) based upon the scope and impact of his or her position as it relates to achieving our corporate goals and objectives; and (3) based on the potential of each executive to assume increasing responsibility within the Company. •• Discourage excessive and imprudent risk-taking. •• Structure the total compensation program to reward the achievement of both the short-term and long-term strategic objectives necessary for sustained optimal business performance. •• Provide a mix of both fixed and variable (“at-risk”) compensation, each of which has a different time horizon and payout form (cash and equity), to reward the achievement of annual and sustained, long-term performance. For the 2023 fiscal year, the pay mix at target for the Chief Executive Officer and the average for the other NEOs is displayed below. 16COMPENSATION PROGRAM OBJECTIVES •• Use our incentive compensation program and plans to align the interests of our executives with those of our stockholders by linking incentive compensation rewards to the achievement of performance goals that maximize stockholder value by: – – Ensuring our compensation programs are consistent with, and supportive of, our short-term and long-term strategic, operating and financial objectives. – – Placing a significant portion of our executives’ compensation at risk, with payouts dependent on the achievement of both corporate and individual performance goals, which are set annually by the Compensation Committee. – – Encouraging balanced performance by employing a variety of performance measures to avoid over-emphasis on the short-term or any one metric. – – Applying judgment and reasonable discretion in making compensation decisions to avoid relying solely on formulaic program design, and to taketaking into account both what has been accomplished and how it has been accomplished in light of the existing commercial environment.conforms toin conformance with best practices in executive compensation and corporate governance. To this end, the Compensation Committee routinely evaluates its practices and programs with respect to executive compensation to identify opportunities for improvement. The Compensation Committee believes a significant portion of the NEOs’ total compensation should be variable and “at risk,” based upon Company earnings from shipping operations (“ESO”) achievement, business/operational metrics and individual performance. To accomplish this, the Compensation Committee uses a balanced weighting of performance measures and metrics in its incentive compensation programs to (i) promote the achievement of its annual operating plan and long-term business strategy; (ii) build long-term stockholder value; and (iii) discourage excessive risk taking by eliminating any inducement to over-emphasize one goal to the detriment of others.DO: We align the interests of our executives and stockholders using performance-based annual cash incentive compensation and service and performance-based long-term cash and equity incentive compensation. Compensation Benchmarking We compare our executives’ total compensation to a consistent peer group for comparable market data. We evaluate that peer group annually to ensure that it remains appropriate, and we add or remove peers only when our Compensation Committee determines, with the advice of its independent compensation consultant, it is clearly warranted. Stock Ownership Guidelines We maintain and track progress against, stock ownership guidelines for our executives and non-employee directors. We have always maintainedmaintain policies and procedures for transactions in the Company’s securities that are designed to ensure compliance with all insider trading rules and that prohibit all hedging, pledging and short-sellingshort selling of our stock by all directors, officers and employees. In 2017, INSW approved the addition of an anti-pledging provision. (“Clawback”) PolicyAll Our Incentive Compensation Recoupment Policy, all of our incentive compensation plans and the terms of our equity agreements provide thatdescribe the circumstances pursuant to which (i) Executive Officers are required to repay or return erroneously awarded compensation to the Company in accordance with clawback rules under the 1934 Act and New York Stock Exchange listing standards or (ii) the Board of Directors or the Compensation Committee may, seek reimbursement of incentives paid or equity-related proceeds providedin its good faith discretion, require officers to an executive officer if it is later determined that the executive officer engaged in misconduct, acted in a manner contraryrepay to the Company’s interestCompany all or breached a non-competition agreement.portion of incentive compensation they receive. Annual Risk Assessment We conduct an annual comprehensive risk analysis of our executive compensation program with our independent compensation consultant to ensure that our program does not encourage inappropriate risk-taking. Independent Compensation Consultant Our Compensation Committee engages an independent compensation consultant to review and provide recommendations regarding our executive compensation program. WHAT WE DO NOT: